PROVINCIAL TREASURER OFFICE

Vision

A sustainable revenue generating andservice oriented office of the Provincial Government of Quezon.

Mission

The Office of the Provincial Treasurer shall optimize its full capabilities to generate sustainable revenue through efficient and effective revenue collection enforcement and strengthened support services to all its stakeholders.

DUTIES and FUNCTIONS

The Provincial Treasurer’s Office core functions as established in the enactment of Republic Act No. 7160 otherwise known as the Local Government Code of 1991 are as follows:

- Advise the Governor, as the case may be, the sanggunian, and other local government and national officials concerned regarding disposition of local government funds, and on such other matters relative to public finance.

- Take custody and exercise proper management of the funds of the Provincial Government of Quezon.

- Take charge of the disbursement of all local government funds and such other funds the custody of which may be entrusted to him by law or other competent authority.

- Inspect private commercial and industrial establishments within the jurisdiction of the local government unit concerned in relation to the implementation of tax ordinances.

- Maintain and update the tax information system of the local government unit.

- Exercise technical supervision over all treasury offices of component cities and municipalities.

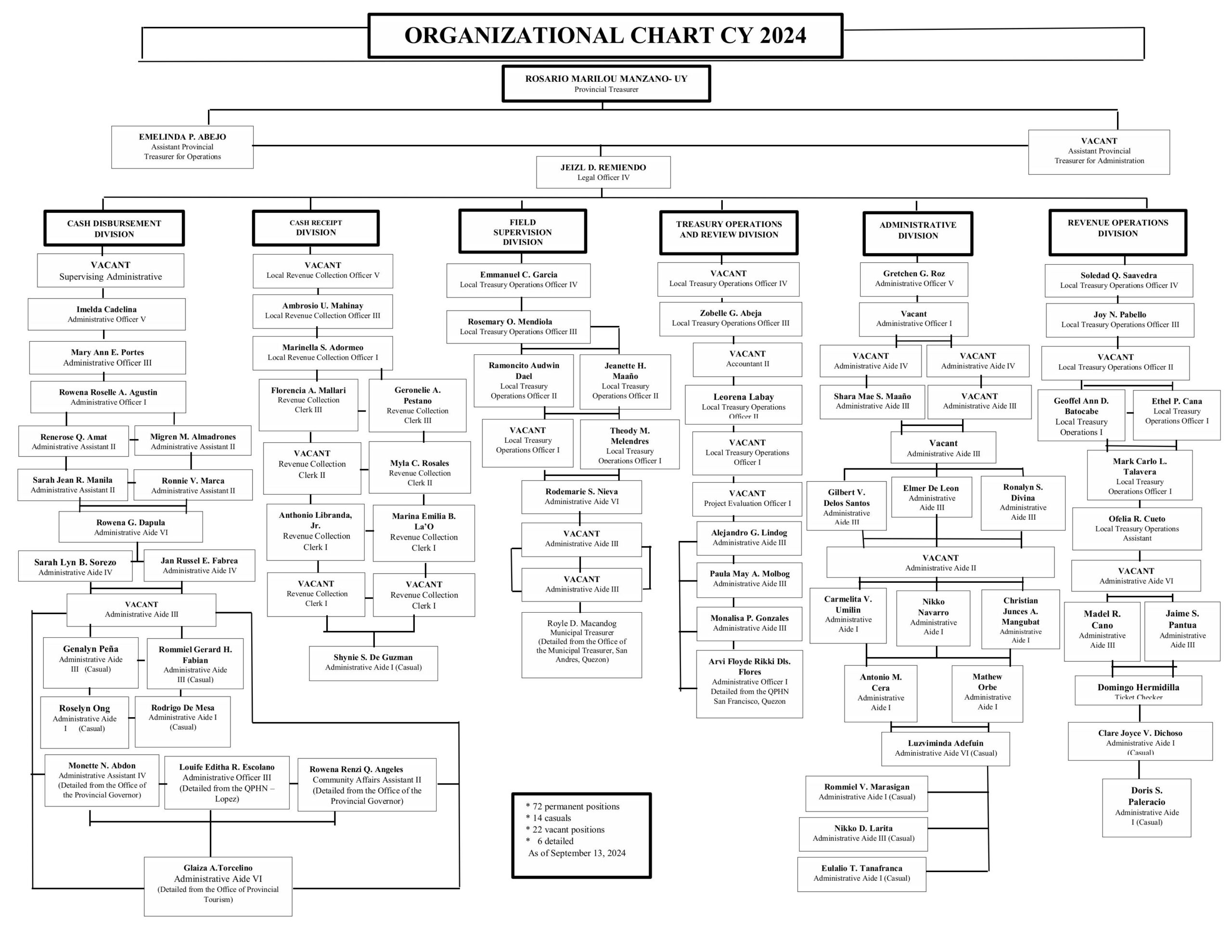

OFFICE DIVISIONS

- REVENUE OPERATIONS DIVISION (ROD)

- Revenue Collection Processing: Streamlining the collection process of provincial taxes, fees, and charges, ensuring accurate and timely receipt of revenue.

- Tax Assessment Computation: Calculating tax liabilities for individuals and businesses based on applicable tax rates and laws, ensuring fair and transparent assessment practices.

- Delinquent Tax Collection: Employing administrative and judicial remedies to recover outstanding tax obligations, including the issuance of notices of delinquency and warrants of distraint and levy.

- Resource Mobilization and Generation: Identifying and pursuing opportunities to increase revenue generation, such as the development of new tax programs or the optimization of existing revenue sources.

- Compliance with Tax Laws: Ensuring strict adherence to provincial tax ordinances, Republic Act No. 7160 (Local Government Code), and other relevant legislation.

- TREASURY OPEARTIONS AND REVIEW DIVISION (TORD)

- Technical Assistance: Offering advice and support to municipal treasurers on a wide range of treasury-related issues, including financial accounting, internal controls, and reporting requirements.

- Administrative Services: Providing administrative support/service to municipal treasury offices, such as training, capacity building, and evaluation of proposed appointments of Municipal and Assistant Municipal Treasurers.

- Internal Accounting: Ensuring the accuracy and integrity of financial records of the province, including the implementation of sound accounting principles and practices.

- Financial Management and Control: Ensuring effective financial management systems, including budgeting, cash flow management, and risk assessment.

- Treasury Performance Evaluation: Monitoring and evaluating the performance of municipal treasuries to ensure accountability.

- Reportorial Compliance: Ensuring that municipal treasuries adhere to all relevant reporting requirementsand other mandated reports to the provincial government and higher authorities.

- ADMINISTRATIVE DIVISION

- Human Resource Management: Staffing and personnel inventory, training and development; and management of employee relations.

- Administrative Management: Coordination of office operations, including scheduling, facilities management, and maintenance.

- Records Management: Organization, storage, retrieval, and disposal of official documents and records.

- Procurement and Inventory: Acquisition, management, and control of office supplies, equipment, and other resources.

- General and Support Services: Provision of administrative support to various divisions and personnel.

- FIELD SUPERVISION DIVISION (FSD)

- CASH DISBURSEMENT DIVISION (CDD)

- Accurate Payment Facilitation: Processing and releasing payments for goods, services, salaries and other financial obligations in accordance with established procedures and regulations.

- Financial Transaction Recording: Monitoring and maintaining details and accurate records of all financial transactions, including receipts, disbursement and bank reconciliations.

- Public Funds Management: Ensuring security, accountability and proper safekeeping of public funds, including the implementation of internal controls and safeguarding procedures.

- Compliance with Regulations: Adhering to all relevant financial regulations, accounting standards and internal control policies to maintain financial integrity and transparency.

- CASH RECEIPT DIVISION (CRD)

The Revenue Operations Division is tasked with the efficient and equitable implementation of provincial tax laws and regulations that contributes significantly to the financial sustainability of the province and the delivery of essential public services. Its primary functions include:

The Division serves as a central hub connecting the provincial treasury with its constituent municipal treasuries. It is responsible for rendering assistance to Municipal Treasurers and executing comprehensive range of administrative and technical services and support on treasury operations and reportorial work. These responsibilities comprise the following areas:

The Administrative Division is tasked with the planning, implementation, and oversight of a wide range of administrative services and secretarial functions essential to the effective operation of the office. These responsibilities span the following areas:

The Field Supervision Division is responsible for conducting field activities such as but not limited to treasury examination, audit and monitoring of municipal treasury performances, transfer of office and accountabilities of Municipal Treasurer and collection performances of accountable personnel of Provincial/District/Municipal Hospital.

The Division is responsible for the treasury disbursement services of the Office ensuring proper accounting, monitoring and safeguarding of public funds. Its primary functions include:

The Cash Receipt Division is responsible for the actual collection of funds/money accruing to the Provincial Government with the corresponding issuance of official receipts as acknowledgement of payment, remittance of all collections of accountable officers in accordance with Commission on Audit rules and regulations and reportorial compliances relative to the collection and deposits of the Office. It also entails safeguarding and safekeeping of all cash accounts, accountable forms and all other accounts and records ensuring adherence to internal control policies and all governing rules and regulations.