PROVINCIAL ACCOUNTANT OFFICE

Mission

It is the mission of the Office of the Provincial Accountant to render utmost quality accounting services to our clients through application of appropriate techniques and latest technology by competent, professional and value oriented personnel that respond to the needs of diverse stakeholders of the Province.

Vision

- A Local Government Office best recognizes for

- Commitment

- Client –oriented and

- Outstanding services performed by

- Unified and

- Noble personnel working as a

- Team

- In response to the

- Needs of the

- General Public

FUNCTIONS

Statement of Objectives and Functions

- To maintain an internal audit system in the local government operations;

- To prepare and submit timely financial statements;

- To apprise the Sanggunian and other local officials on the financial condition and operations of the provincial government;

- To certify to the availability of budgetary allotment to which expenditures and obligations may be properly charged;

- To review supporting documents and determine completeness of requirements before preparation of vouchers;

- To prepare statements of cash advances, liquidation, salaries, allowances, reimbursements and remittances;

- To maintain individual records of payments to officials, employees, suppliers, contractors and other claimants;

- To keep a complete record of all financial transactions of the provincial government.

MANDATE

The important role and functions of the Office of the Provincial Accountant as provided in Republic Act 7160 (Local Government Code of 1991) to wit:

Article IV Section 474 of the Local Government Code (R.A. 7160)

The accountant shall take charge of both the accounting and internal audit services of the local government unit concerned and shall;

- Install and maintain an internal audit system in the local government unit concerned;

- Prepare and submit financial statements to the governor or mayor, as the case may be, and to the Sanggunian concerned;

- Apprise the Sanggunian and other local government officials on the financial condition and operations of the local government unit concerned;

- Certify to the availability of budgetary allotment to which expenditures and obligations may be properly charged;

- Review supporting documents before preparation of voucher to determine completeness of requirements;

- Prepare statements of cash advances, liquidation, salaries, allowances, reimbursements and remittances pertaining to the local government unit;

- Prepare statements of journal vouchers and liquidation of the same and other adjustments related thereof;

- Post individual disbursement to the subsidiary ledger and index cards;

- Maintain individual ledgers for officials and employees of the local government unit pertaining to payroll and deductions;

- Record and post in index cards details of purchase of furniture, fixtures and equipment, including disposal thereof, if any;

- Account for all issued requests for obligations (now Allotment and Obligation Slip) and maintain and keep all records and reports related thereof;

- Prepare journals and the analysis of obligations and maintain and keep all records and reports related thereto; and

- Exercise such other powers and perform such other duties and functions as may be provided by law or ordinance.

In summary, the Code (R.A. 7160) provides that the Office of the Provincial Accountant has the responsibility of recording, analyzing, interpreting, classifying and examining all monetary transactions of the Province as a whole in consonance with the principle of decentralization.

PRODUCT/SERVICES

- Processing of disbursement vouchers, payrolls and liquidation reports

- Approved Journal Entry Vouchers for paid vouchers, payrolls, collections, liquidation reports, debit and credit advice from banks and other adjustments

- Ledgers and index cards

- Financial reports

- Schedule of cash advances and liquidations

- Endorsement letters

- Remittances to government agencies

- Certifications and pay slips

- Bank and subsidiary ledger reconciliation

- Summary of journal entry vouchers

- Fund Utilization Reports

- Verification of loan application of employees

- Refund of loan amortizations

- Statement of income and expenditures

- Statement of debt services

OFFICIAL EMAIL ADDRESSES

pgquezon.acctg@gmail.com

CONTACT NUMBERS

| Telephone number: | (042) 373-8160 |

| Cellphone number: | |

| • Smart/TNT/Sun: | 0922 271 2586 |

| • Globe/TM/Dito: | 0917 566 9076 0956 412 9367 |

OFFICIAL EMAIL ADDRESSES

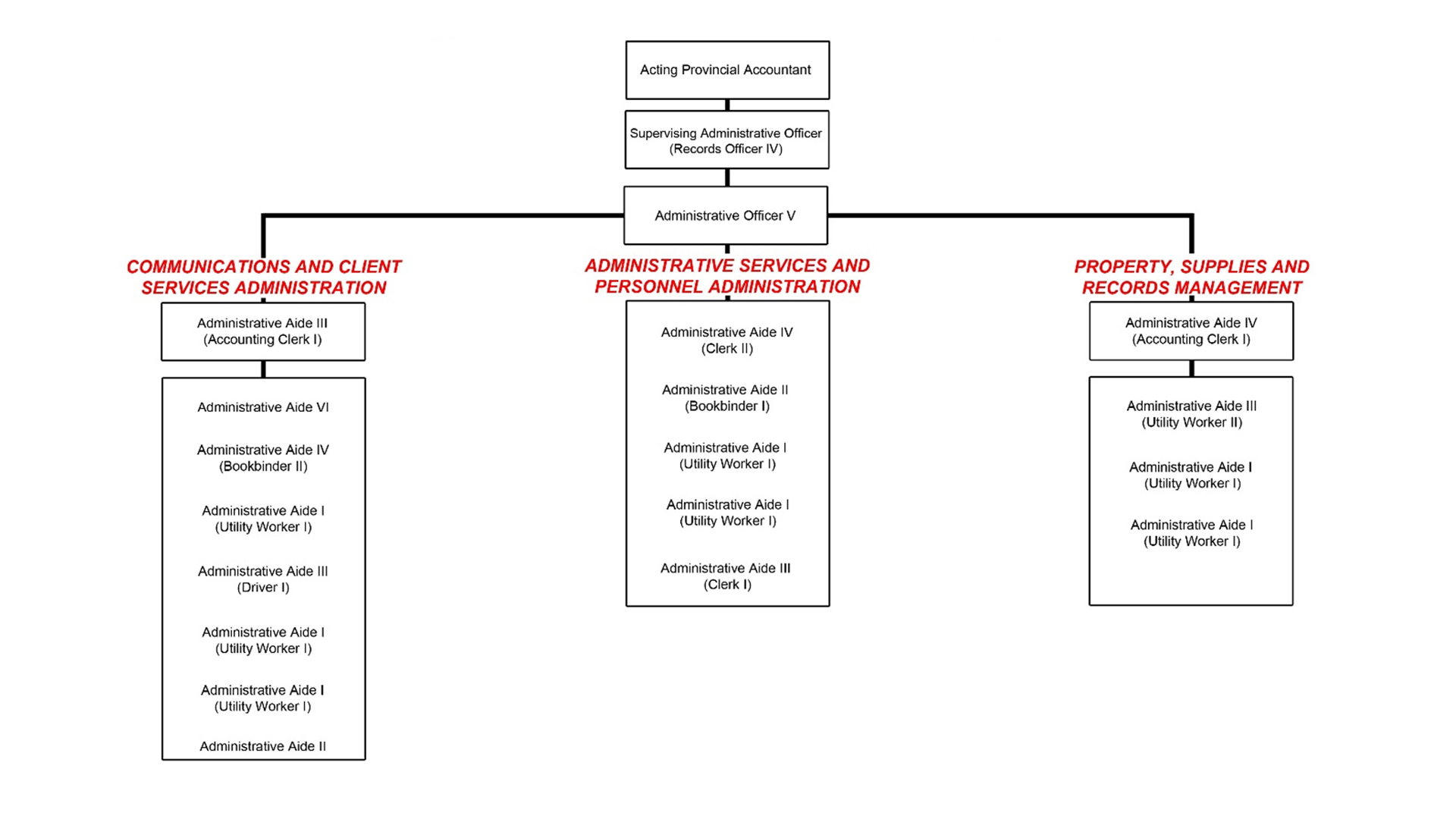

RECORDS AND ADMINISTRATIVE DIVISION

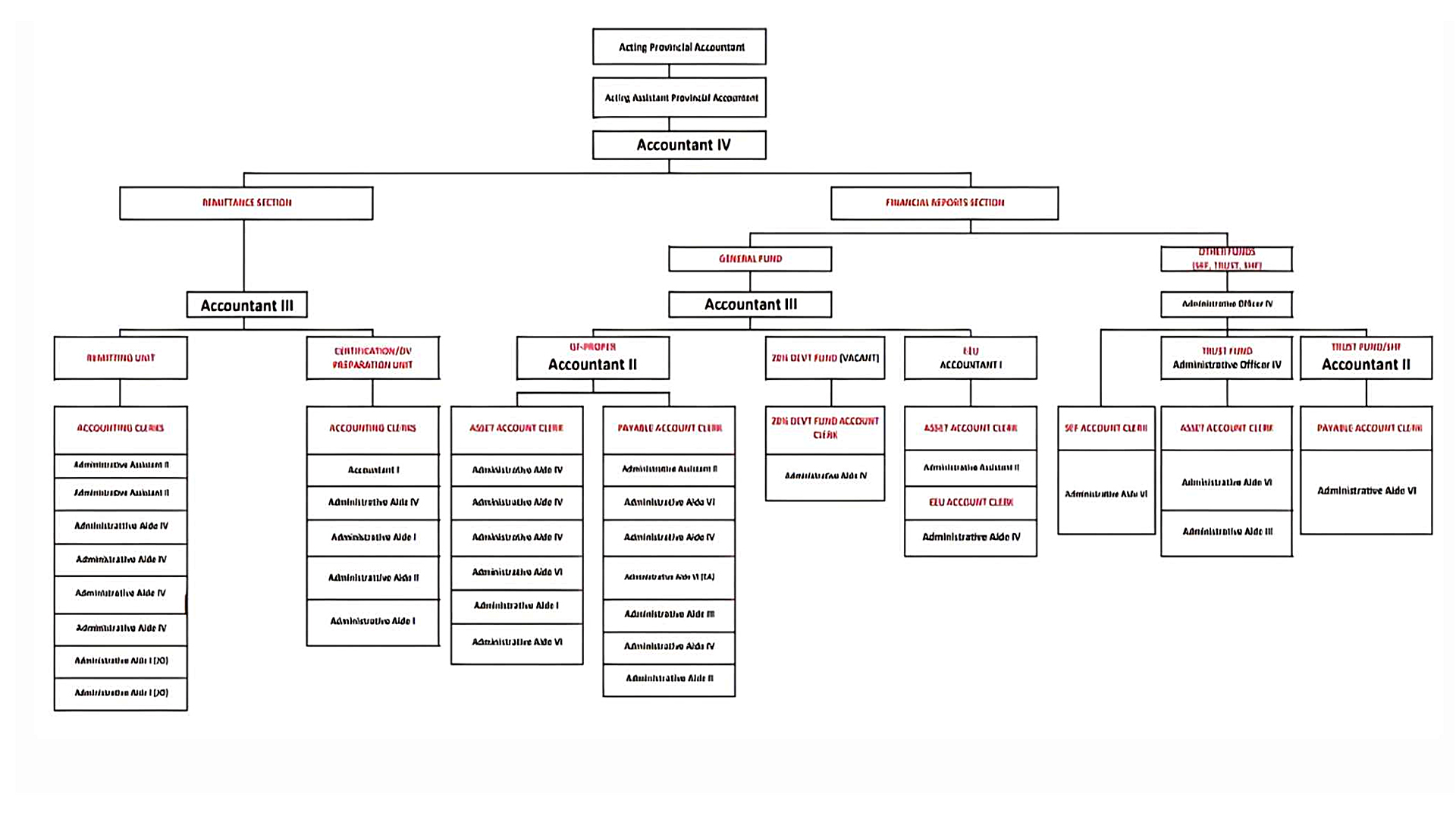

REPORTS AND REMITTANCES DIVISION

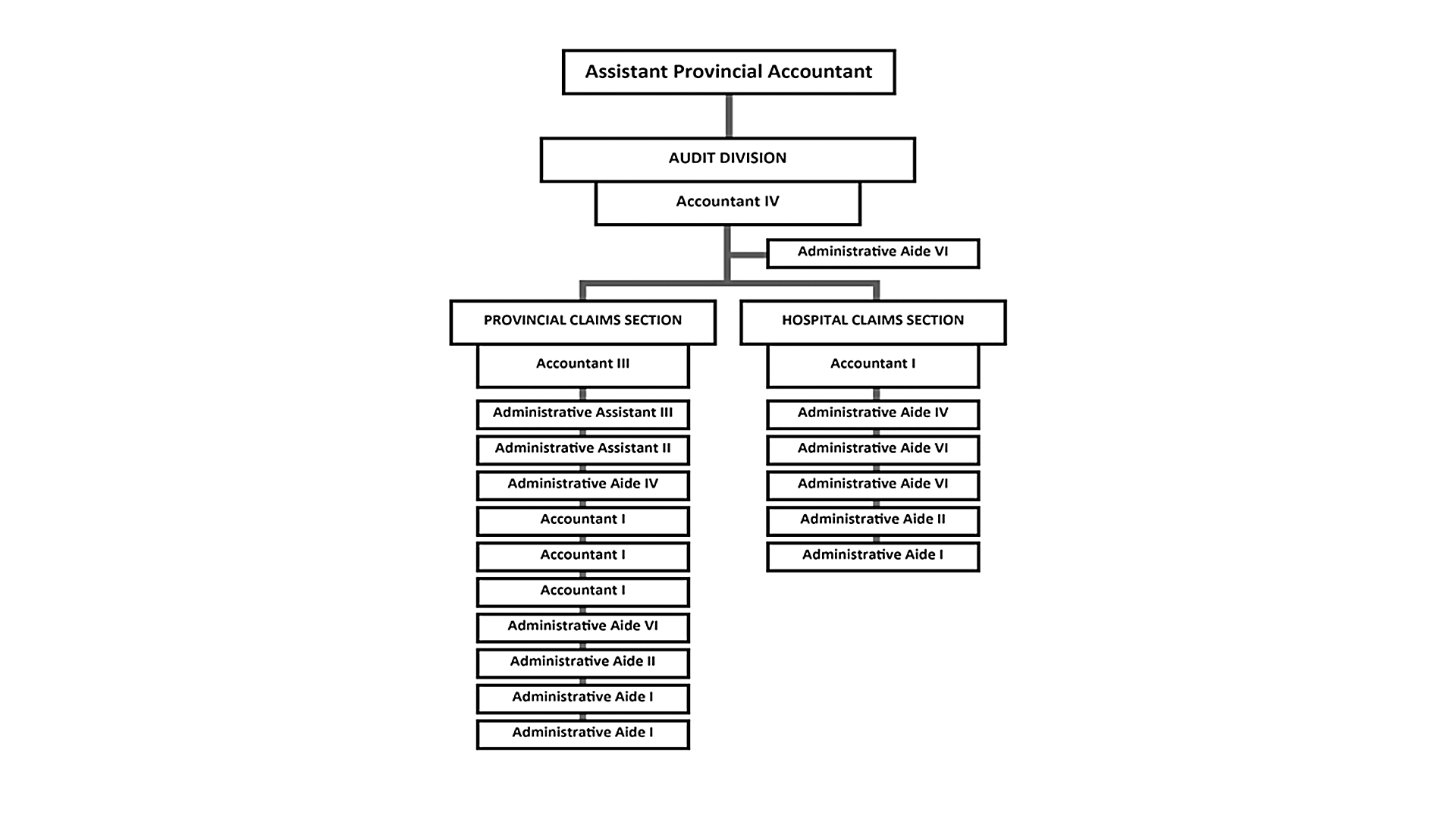

AUDIT DIVISION

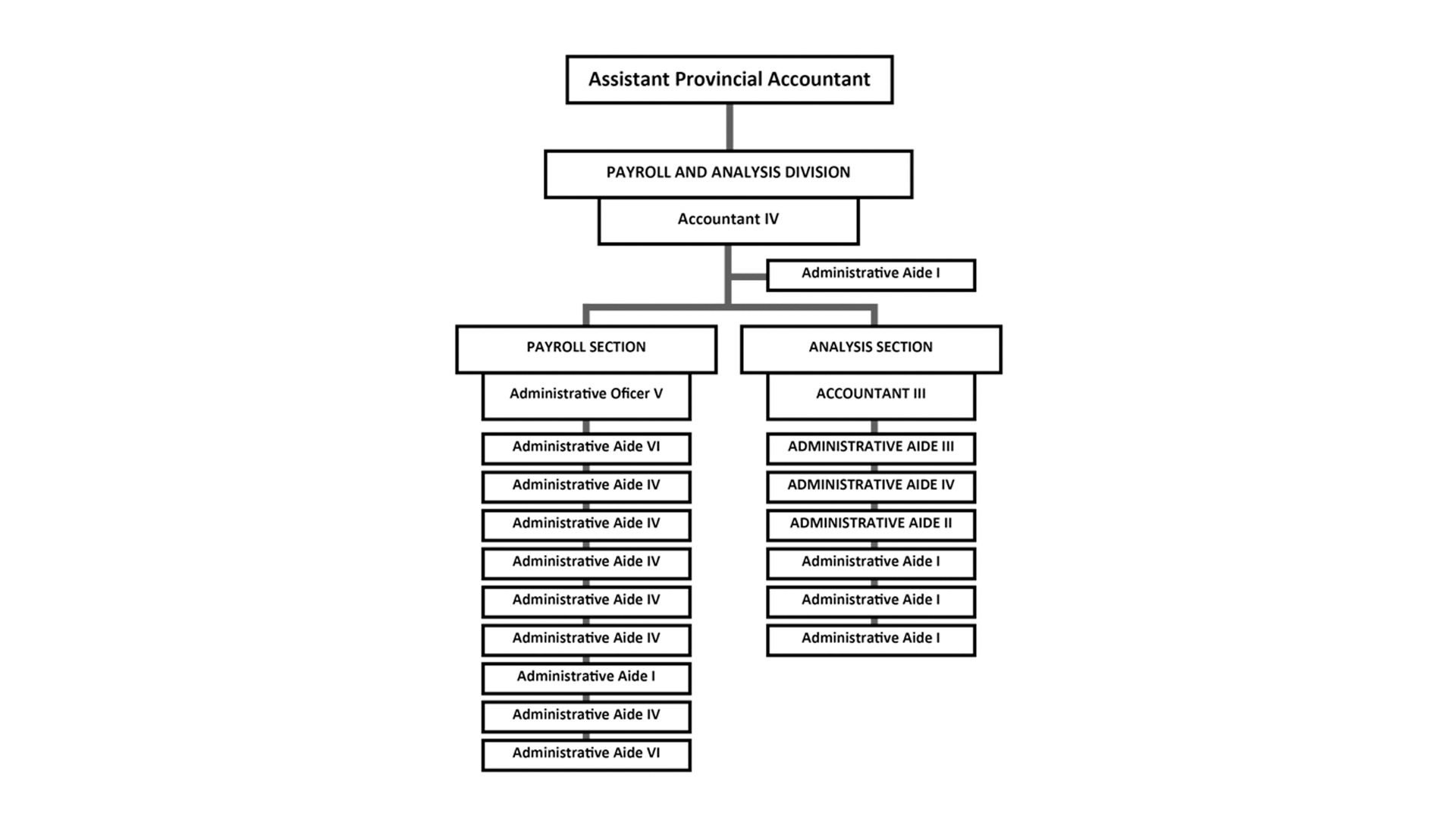

PAYROLL AND ANALYSISDIVISION